You may think you know the difference between an employee and an independent contractor, but it’s worth making sure since the California Supreme Court recently revisited and clarified worker classification rules.

Historically, the common interpretation of California law was that an independent contractor was a worker with the “right to control the manner and means of accomplishing the result desired.”

However, on April 30, 2018 the California Supreme Court ruling on Dynamex Operations West, Inc. v. Superior Court changed that interpretation.

According to the Dynamex case, the presumption is that workers are employees who should be on the payroll and protected by the California Wage Orders established by the Industrial Welfare Commission.

Protections under the California Wage Orders include things like minimum wage, maximum work hours, overtime pay, and other humane working conditions like meal and rest breaks.

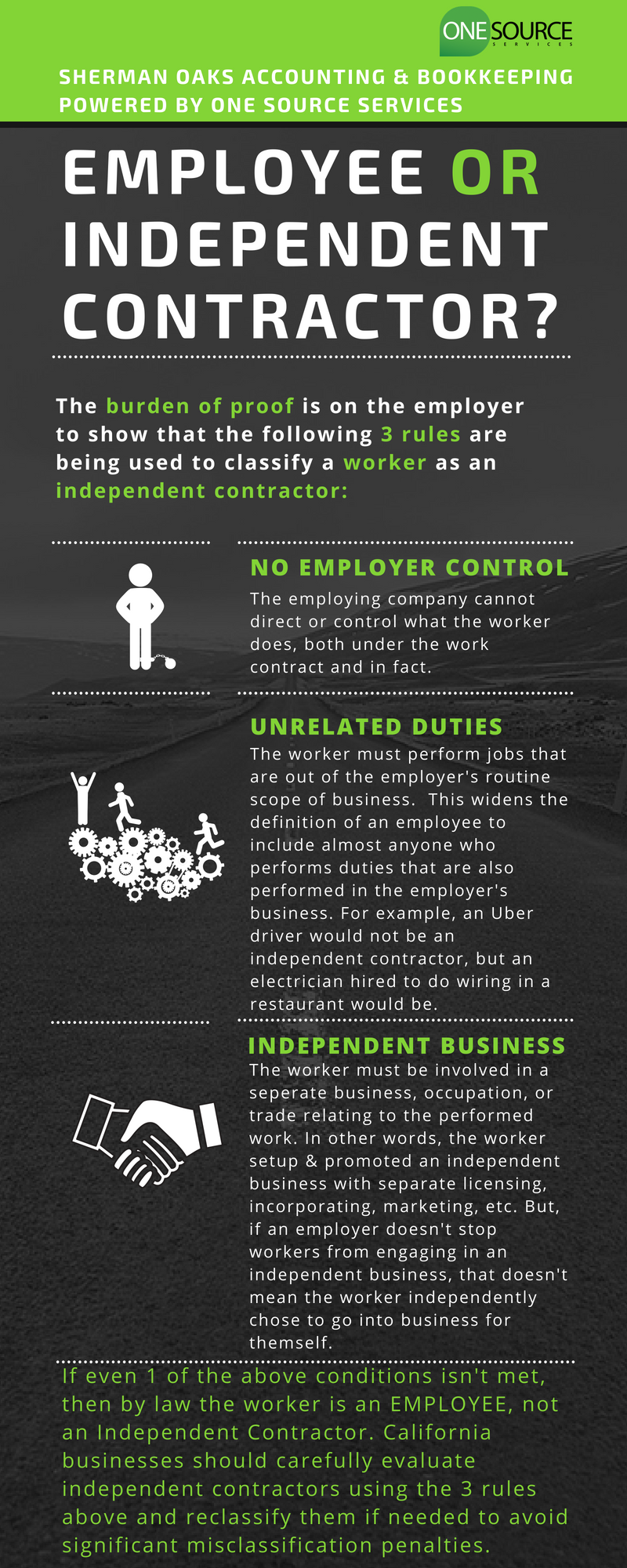

According to the recent ruling, the burden of proof now falls on the employing company to show that a worker is not an employee and is instead an independent contractor.

Sherman Oaks Accounting & Bookkeeping powered by One Source Services, Inc. created the below “Employee Or Independent Contractor” info-graphic. To legally classify a worker as an independent contractor, an employer must ensure that they closely follow all three rules:

It’s worth repeating that if even ONE condition is not met, then the worker is legally an employee, not an independent contractor, and is therefore protected under the California Wage Orders described above.

It also means that the employing company must pay social security, Medicare, and unemployment taxes as well as provide worker’s compensation insurance.

Penalties for misclassifying employees as independent contractors and vice versa can be significant!

Consequences can include EDD tax audits, litigation from workers who claim they were misclassified, and large civil penalties up to $15,000 for each “willful misclassification of an individual as an independent contractor.”

Sherman Oaks Accounting & Bookkeeping powered by One Source Services, Inc. strongly suggests that all California businesses use the “Employee Or Independent Contractor” Info-graphic included in this article above to carefully evaluate their current independent contractors.

It is critical that independent contractors are reclassified as employees if even one condition is not met.

We are available to assist you if you need help with payroll including worker classification and documentation to protect your position.

Furthermore, we can connect you with labor attorney partners if more advanced worker classification assistance is required.